Are you curious about the world of cryptocurrency investments but not sure where to start? With the rise of digital currencies like Bitcoin and Ethereum, more and more people are looking to get in on the action. But navigating this complex and volatile market can be daunting for beginners. In this beginner’s guide, we will break down the basics of investing in cryptocurrency, from understanding the technology behind it to tips for building a successful investment strategy. So whether you’re a seasoned investor looking to diversify your portfolio or a complete newbie in the world of digital assets, this guide will help you unlock the potential of cryptocurrency investments.

Understanding the Basics of Cryptocurrency Investment

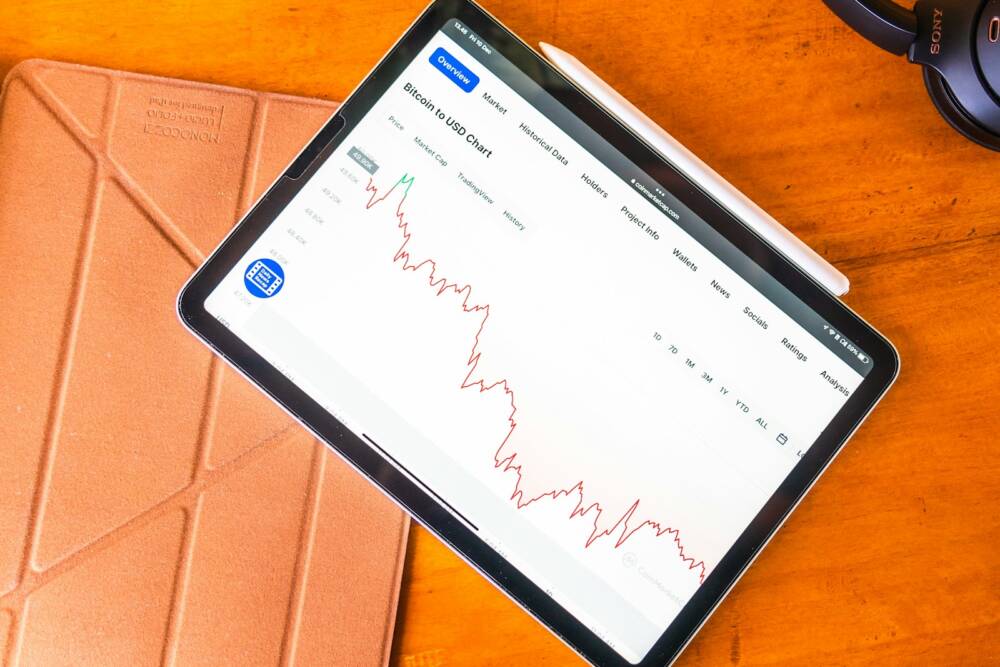

Cryptocurrency investments have been gaining popularity in recent years, offering investors the opportunity to diversify their portfolios and potentially earn significant returns. However, is crucial before diving into this exciting and volatile market.

One of the key concepts to grasp when investing in cryptocurrency is the idea of blockchain technology. This decentralized system allows for secure and transparent transactions, making it a revolutionary tool for conducting financial transactions. Additionally, it’s important to research and choose the right cryptocurrency to invest in, as there are thousands of options available. Some popular choices include Bitcoin, Ethereum, and Litecoin. Before investing, it’s essential to consider factors such as market trends, volatility, and the technology behind the cryptocurrency. By educating yourself on these key aspects, you can unlock the potential of cryptocurrency investments and make informed decisions that align with your financial goals.

Exploring Different Cryptocurrencies for Investment

Cryptocurrency investments have gained popularity in recent years as more people look for alternative ways to grow their wealth. With a wide range of digital currencies available, it can be overwhelming to decide where to invest your money. One of the key benefits of investing in cryptocurrencies is the potential for high returns, but it’s important to do your research before diving in.

When , consider factors such Market trends, technology supporting digital currency, and the project team. Diversifying your portfolio with a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as newer altcoins, can help spread risk and maximize potential gains. Keep in mind that the cryptocurrency market is highly volatile, so it’s important to only invest what you can afford to lose. Stay informed about market news and developments to make well-informed investment decisions. Remember, the key to successful cryptocurrency investing is to stay patient and stay informed.

Strategies for Successful Cryptocurrency Investing

Cryptocurrency investing can be a lucrative venture if approached with the right strategies. To unlock the potential of your investments, it’s important to conduct thorough research and stay informed about market trends. Diversifying your portfolio, setting clear investment goals, and staying disciplined are key factors in achieving success in the volatile world of cryptocurrency.

One effective strategy is to diversify your investments across different types of cryptocurrencies. By spreading your investments, you can mitigate risks and take advantage of potential growth opportunities in various sectors of the market. Additionally, setting clear investment goals and sticking to a well-defined plan can help you avoid making emotional decisions during times of market volatility. Remember to stay disciplined and avoid chasing short-term gains, as this can lead to losses in the long run. By following these strategies, you can unlock the full potential of your cryptocurrency investments and achieve success in this exciting and rapidly evolving market.

Maximizing Returns through Diversification in Cryptocurrency Portfolio

Cryptocurrency investments have become increasingly popular in recent years, offering a potentially lucrative opportunity for investors. However, with the volatile nature of the cryptocurrency market, it is essential to diversify your portfolio to maximize returns and minimize risks. Diversification involves spreading your investments across different cryptocurrencies to reduce the impact of any single asset’s price fluctuations on your overall portfolio. By diversifying, you can potentially increase your chances of achieving attractive returns while also protecting yourself against significant losses.

One way to diversify your cryptocurrency portfolio is by investing in a mix of established cryptocurrencies, such as Bitcoin and Ethereum, as well as up-and-coming altcoins. Each cryptocurrency has its unique characteristics and market trends, so by holding a variety of assets, you can benefit from different growth opportunities and mitigate the risk of being overly exposed to a single asset. Additionally, consider allocating your investments across different sectors within the cryptocurrency market, such as decentralized finance (DeFi) tokens, privacy coins, and stablecoins. This approach can help you capitalize on diverse market trends and potentially enhance your overall portfolio performance. By strategically diversifying your cryptocurrency investments, you can unlock the full potential of this exciting asset class and position yourself for long-term success in the ever-evolving digital economy.

The Way Forward

As you navigate the exciting world of cryptocurrency investments, remember to always do your research, stay informed, and never invest more than you can afford to lose. With the right knowledge and strategy, the Limitless potential for growth and success in this market. So go ahead, unlock the potential of cryptocurrency investments and watch your portfolio soar to new heights. Happy investing!