Since the creation of crypto over a decade ago, bear markets have been part of the sector. These bear markets serve as corrections, stabilizing prices when they go too high. A bear market can sometimes lead to a crypto winter.

Crypto winter is a worse version of a bear market. What happens is that prices experience a massive drop, followed by successive massive drops. While the crypto industry has experienced crypto winters, the current one is unlike anything experienced in the past.

One reason it is much worse is that the crypto market has matured significantly since its founding over ten years ago. Consequently, a lot of capital from traditional markets was tied in with crypto. The collapse of Terra Luna triggered a series of events that led to customers losing their funds and companies filing for bankruptcy.

Despite Crypto Winter, Many Investing In MOSDEX

While crypto winter has gripped the crypto industry, investments in some areas of the crypto sector are still ongoing. An excellent example of this is the MOSDEX platform. While all experts agree that the sector is amid a prolonged bear market, investment in MOSDEX has not let up. It is thus important to understand why the MOSDEX platform has proven attractive to investors despite the crypto market downturn. To do that, one needs to understand crypto arbitrage.

How Crypto Arbitrage Trading Works

MOSDEX is a platform that uses advanced technology to make money for traders via crypto arbitrage. At its most basic, crypto arbitrage is the process of capitalizing on the small price differences of crypto coins on multiple exchanges. It entails buying crypto at a low price on one platform and selling it on another at a higher price.

The process involves minimal risk. Best of all, it does not require expert knowledge to understand how it works. Arbitrage trading has been used in the financial markets for hundreds of years. However, the crypto sector offers more arbitrage opportunities.

This is because crypto markets are fragmented, unlike traditional markets, which often synchronize their data. Besides being fragmented, the crypto markets are highly volatile, which presents numerous opportunities for crypto arbitrage trading. Another reason is that crypto markets are 24/7, so there are always opportunities for arbitrage trading.

Why do Price Differences Exist?

One reason is that the price of a crypto asset on a centralized exchange is based on the most recent bid-ask matched order. In short, the most recent price at which traders buy and sell digital assets is the real-time price of an asset. Consequently, price discovery on exchanges is a continuous process. Prices vary on the different exchanges since the demand for any asset will vary between various exchanges.

On decentralized exchanges, the automated market maker system is used to price assets. It relies on crypto arbitrage traders to keep prices in line with the market. Instead of an order book, liquidity pools are used. For each trading pair, there is a separate trading pool.

Volunteers deposit funds for liquidity purposes in each pool. Traders then trade against these funds. A major benefit of the decentralized model is that traders do not rely on a counterparty to buy or sell assets at a set price. A mathematical formula is used to maintain prices in a liquidity pool with two assets.

When traders buy B from an A/B pool, they need to add A to the pool to remove B. When they do that, the ratio of the assets will change with more A in the pool and less B. To restore balance, the protocol will lower the price of A and raise the price of B. It encourages traders to remove the cheaper A and add B until prices regain balance with the market. Sometimes, a trader will change the ratio of the A/B pool so much that it can cause significant changes compared to the market.

Crypto Arbitrage on MOSDEX

Software engineers and financial markets developed Mosdex experts who honed their skills in the capital markets. One of their most notable achievements is creating the software that powers the Moscow Stock Exchange. Today, Mosdex is designed to help every customer with a passive income opportunity, even during crypto winter.

From the description above, it may seem like anyone can engage in crypto arbitrage in their free time. However, the process is extremely complex in real life. One reason for this is that arbitrage opportunities occur in seconds or less. It would be impossible for any human being to compare prices at more than two exchanges every few minutes.

By then, the arbitrage opportunity will have disappeared. Mosdex uses powerful computing and proprietary software to ensure success when identifying arbitrage opportunities at multiple platforms. It can sift through thousands of gigabytes of data every few seconds—machine learning and AI aid the computing system in its function. Consequently, every possible opportunity to make some money is utilized.

Another benefit of using Mosdex is that it can process transactions in bulk. Doing so helps to eliminate the fees that come with processing the thousands of transactions necessary to profit from crypto arbitrage. The fees-per-transaction would eat into the tiny profit margins of individual crypto arbitrage trading. Mosdex also helps deal with the liquidity challenges of trading across multiple exchanges.

Mosdex has already proved its technology works in the capital markets. The crypto market, while more volatile, is many times smaller than the global capital markets. As such, Mosdex can handle the crypto markets with ease. Those who have already signed up can attest that the technology works.

The MOSDEX Crypto Arbitrage Engine

The arbitrage engine on Mosdex makes it the most profitable crypto arbitrage platform in the world. It uses a simple cycle to ensure that all arbitrage opportunities are fully utilized.

When traders send their funds to Mosdex, the engine will begin scanning and comparing prices on exchanges and trading platforms. AI is at the center of its decision-making; its role is to find exchanges with the highest volatility. It purchases tokens at the lowest price while selling them at the highest price. These decisions are made and executed in milliseconds.

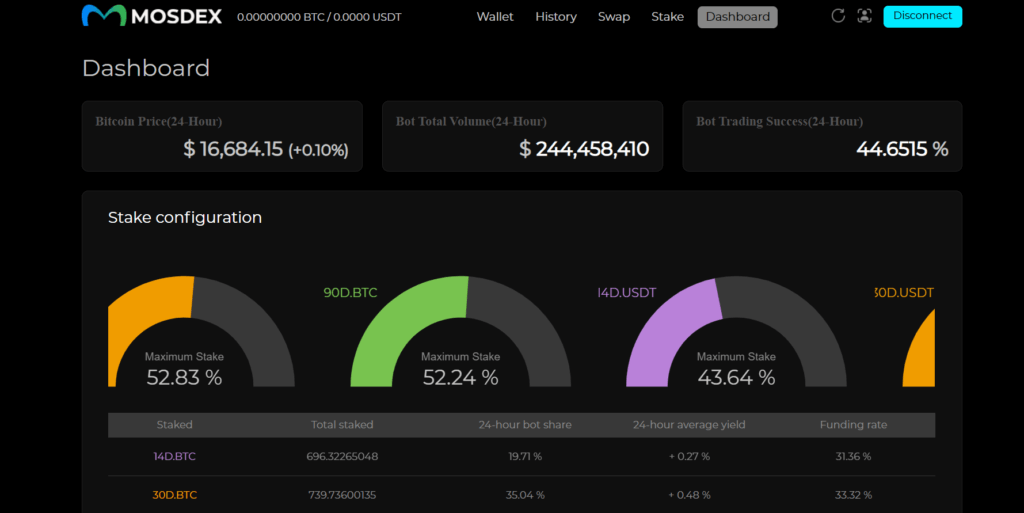

Thousands of transactions are executed in a minute. The engine explores and utilizes opportunities that no human could ever benefit from on their own. Once the trades are complete, the profits are sent to the account, and the funds are unlocked. Owners of the funds can withdraw or lock them up again for more opportunities to profit. Locking up funds ensures that you can compound your initial investment.

Due to the high volatility of the crypto markets, arbitrage opportunities can always be found in the crypto markets. Consequently, investors can continue to earn a passive income even in crypto winter.

Arbitrage Strategies Used by the Mosdex Engine

To achieve profitability at all times, Mosdex combines several arbitrage trading strategies. These are:

Cross-Exchange Arbitrage

This is the most basic form of arbitrage. It entails buying crypto assets from one crypto exchange and selling them on another. The Mosdex engine identifies price differences at different exchanges, with the help of AI, to take advantage of every arbitrage opportunity. Thousands of trades are completed every few seconds to ensure maximum profitability.

Triangular Exchange

This system entails moving funds between three or more crypto assets. Since it takes place on a single exchange, no exchange fees are involved in the loop. A good example is a BTC, LTC, and XRP loop. It involves selling BTC for ETH and buying LTC with ETH. After that, one can buy BTC with LTC. During the process, all small price differences between the coins will lead to more BTC at the end of the loop.

DeFi Arbitrage

DeFi arbitrage is possible on decentralized exchanges using a smart contract and algorithms on the blockchain. With the smart contract, Mosdex will look for any crypto prices that differ from spot prices on centralized exchanges. Once it identifies the opportunities, a cross-exchange trade is started. It entails moving tokens from centralized to decentralized exchanges to benefit from the price differences.

Staking-Based Arbitrage

Mosdex utilizes a crypto-staking protocol that has a proprietary profit-sharing model built into it. Its purpose is to maximize yield using yield arbitrage. For instance, if A has a yield of 10% p.a. and B has a yield of 17% p.a., the protocol will swap A for B with its higher yield. When the protocol swaps B back for A, it will benefit from the 7% increase in yield. The profit-sharing model built into the protocol ensures that users of Mosdex will enjoy huge profits for their investments.

The protocol is powered by a complex algorithm, which identifies arbitrage opportunities for staked assets at reduced costs. Mosdex’s massive computing power ensures decisions are executed in milliseconds to benefit from every arbitrage opportunity for staked assets.

Summary

Users of MOSDEX do not need any technical expertise on how crypto trading works. All they need is to sign up for an account on MOSDEX, deposit some funds, and watch their investment compound.

MKTPlace is a leading digital and social media platform for traders and investors. MKTPlace offers premiere resources for trading and investing education, digital resources for personal finance, news about IoT, AI, Blockchain, Business, market analysis and education resources and guides.