Australia is the 6th largest country in the world by landmass, and its economy is the 13th largest in the world. Its economy is larger than Spain, which has twice the population. It’s a powerhouse in the pacific and is a major player in the global marketplace.

For those looking to diversify their personal investment portfolios here in the US, investing in ASX stocks makes a lot of sense. The continent is full of natural resources, making it a country known for its exports.

It’s home to the largest mining company in the world, and there are more than 300 mines in total across the nation.

Since the world depends on Australia’s resources, it’s a safe bet when choosing a foreign nation to invest in.

Looking to learn more about Australian stocks? Keep reading below for information on investing in the ASX exchange.

ASX Stocks to Consider

BHP is one of the first stocks that foreign investors are drawn to. BHP is the largest mining company in the world, as mentioned earlier.

The company got started in 1885. It made it on the list of the 100 largest companies in the world.

Like wine with your ROI? Then consider Treasury Wine Estates Limited (ASX: TWE.AX).

Based in Melbourne, this winemaker was founded in 1843 and owns a number of prominent wine brands. The majority of its vineyards are scattered across Australia, but it also has an interest in the US, Italy, and New Zealand.

Wesfarmers Limited (ASX: WES.AX) is headquartered in Perth. They are a retail company, providing building materials and home improvement products. It also focuses on chemicals and fertilizers and has seen tremendous growth in recent months.

Aside from these companies are plenty of others focused on healthcare, technology, and mining. Australia is known for its exports of iron, gold, petroleum, coal, and aluminum.

How to Invest in the Australia Security Exchange

Ready to put some money into the Australian stock index? If you’re not an Australian, you can start with companies that have dual stock listings. Many Australian companies have their shares listed on both the ASX and on US stock exchanges.

Or you can purchase shares of an ETF in the US, like the Australian Dividend Harvester Fund ETF.

But if you’d prefer to have more control over your Australian investments, you’ll want to use a broker that allows you to buy from the ASX directly. Monex Securities is an Australian-based company that lets you do exactly that.

Not only can you use their brokerage to invest in the ASX, but you can also use it to invest in a dozen Asian markets as well, such as Japan or Indonesia. You can click here to get started on the ASX today.

Diversification Is Key

ASX stocks are among the top-performing in the world. There’s no reason not to add some of them to your portfolio, to diversify and strengthen your investments.

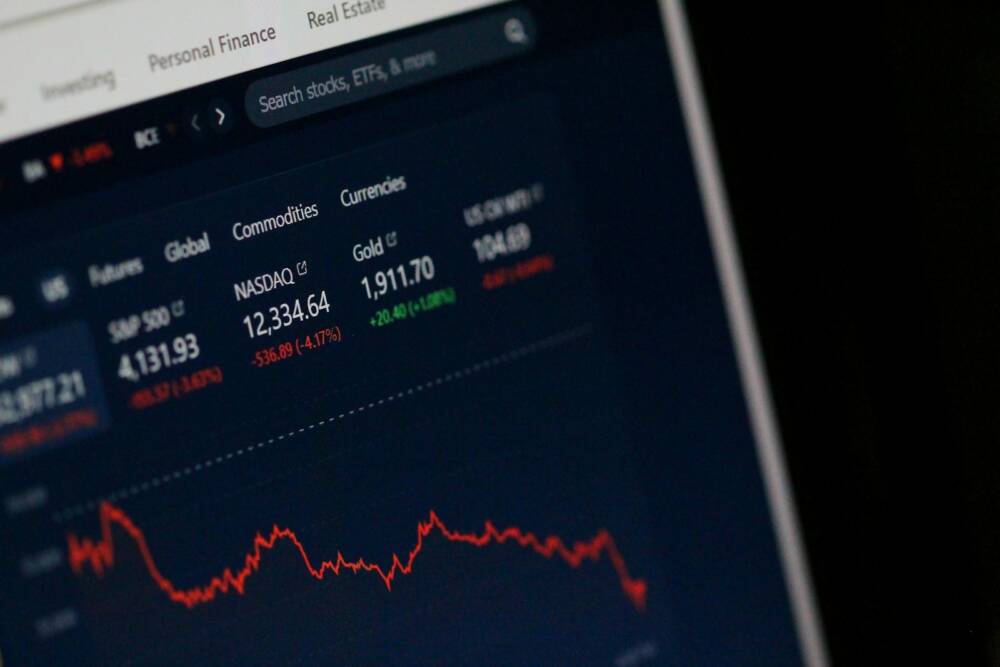

Looking to learn more about currency ASX stock prices? Want more investment tips and tricks? Then head over to our blog to find all the articles you need.

MKTPlace is a leading digital and social media platform for traders and investors. MKTPlace offers premiere resources for trading and investing education, digital resources for personal finance, news about IoT, AI, Blockchain, Business, market analysis and education resources and guides.