Have you ever found yourself scrolling through news articles or social media posts about cryptocurrency market trends, feeling like you’re on a wild rollercoaster ride with no seatbelt? The world of cryptocurrency can be exhilarating, confusing, and downright unpredictable at times. In this article, we’re going to take a deep dive into the ups and downs of the cryptocurrency market, breaking down the trends and exploring what makes this digital currency world so fascinating. So buckle up, because we’re about to embark on a wild ride through the world of cryptocurrency.

Unpacking the Current State of Cryptocurrency Market Trends

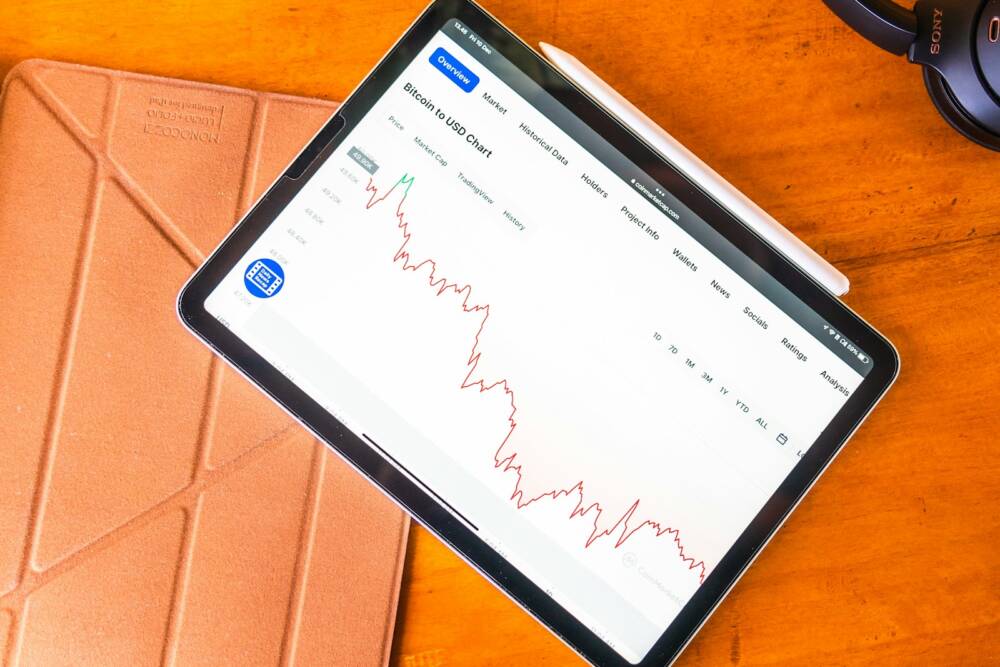

Cryptocurrency market trends have been a rollercoaster ride in recent times, with prices soaring to new heights one day and plummeting the next. It’s essential to understand the factors driving these fluctuations to navigate this volatile market successfully.

One of the key trends in the cryptocurrency market is the growing interest from institutional investors. Big players like banks and hedge funds are starting to dip their toes into the world of digital assets, bringing more legitimacy and stability to the market. Additionally, the rise of decentralized finance (DeFi) projects has been a game-changer, offering innovative ways to earn interest and borrow funds using cryptocurrencies. These trends are reshaping the landscape of the cryptocurrency market and paving the way for mainstream adoption.

Another significant trend to watch is the regulatory landscape surrounding cryptocurrencies. As governments around the world grapple with how to regulate this new asset class, uncertainty and volatility are likely to persist. Navigating these regulatory challenges will be crucial for the long-term success of cryptocurrencies. Stay tuned for more insights on the wild ride that is the cryptocurrency market!

Analyzing the Impact of External Factors on Cryptocurrency Prices

Cryptocurrency prices are known for their volatility, constantly fluctuating in response to a variety of external factors. Factors such as regulatory developments, market sentiment, technological advancements, and macroeconomic trends all play a role in determining the value of digital assets. By analyzing these external factors, investors can gain valuable insights into market trends and make more informed decisions when buying or selling cryptocurrencies.

One key external factor that can impact cryptocurrency prices is regulatory developments. Government regulations and policies regarding cryptocurrencies can have a significant impact on market sentiment and investor confidence. For example, news of a ban on cryptocurrency trading in a major market can lead to a sharp decline in prices, while regulatory clarity and support from governments can boost prices. Market sentiment is another important external factor that can influence cryptocurrency prices. Positive news stories, celebrity endorsements, and investor sentiment can all contribute to a bullish market, driving prices higher. Conversely, negative news stories, security breaches, and market manipulation can lead to a bearish market, causing prices to plummet. By staying informed about these external factors, investors can better understand the forces driving cryptocurrency prices and adjust their investment strategies accordingly.

Navigating the Volatility of Cryptocurrency Investments

Cryptocurrency investments have been a hot topic in the financial world, with the market experiencing extreme volatility. Understanding and navigating this rollercoaster ride can be daunting for both seasoned investors and newcomers alike. However, by breaking down the wild ride and delving deep into cryptocurrency market trends, we can gain valuable insights into how to make informed decisions in this fast-paced environment.

One key trend in the cryptocurrency market is the rapid fluctuation of prices. This volatility can be influenced by a myriad of factors, such as market demand, regulatory changes, and even social media trends. It is important for investors to stay informed and constantly monitor these trends to capitalize on potential opportunities and mitigate risks. Additionally, diversifying your investment portfolio across different cryptocurrencies can help spread out risk and potentially increase your chances of success in this unpredictable market. By staying educated and adaptable, investors can navigate the volatility of cryptocurrency investments with confidence and strategy.

Strategies for Maximizing Profits in the Cryptocurrency Market

Cryptocurrency market trends can be a wild ride for investors, with prices fluctuating dramatically and new coins entering the market regularly. To maximize profits in this volatile environment, it is important to have a solid strategy in place. One key strategy is diversification – spreading your investments across a range of different coins can help to minimize risk and maximize potential returns. Additionally, staying informed about market trends and developments is crucial for making smart investment decisions.

Another important strategy for maximizing profits in the cryptocurrency market is to buy low and sell high. This may sound simple in theory, but in practice, it requires patience and discipline. Keeping a close eye on price movements and market trends can help you identify buying opportunities when prices are low and selling opportunities when prices are high. Additionally, setting stop-loss orders can help you limit losses and protect your profits. By following these strategies and staying informed about market trends, you can increase your chances of success in the cryptocurrency market.

Wrapping Up

And there you have it, folks! We’ve delved into the wild world of cryptocurrency market trends, exploring the highs and lows, the twists and turns, and the rollercoaster ride that is investing in digital currencies. Whether you’re a seasoned trader or a curious beginner, one thing is for sure - the cryptocurrency market is always evolving and never boring. So buckle up, stay informed, and enjoy the ride as we continue to navigate the exciting and unpredictable world of cryptocurrencies. Happy trading!

Janet Ekelt is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Janet has also been Editorial Writer at The Irish Times, a leading Irish English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.