Are you looking for investments that you can hold rather than leaving them in a bank? Have you heard about investing in gold coins but aren’t sure how to get started? Why investing in gold?

The rate of inflation in the US rose to over 6.5 percent last year. This means that the value of the dollars in your savings account is lower than they were a year ago.

If you want to buy some tangible assets that will rise in value, you might want to invest in gold. Here are some great reasons to get started now.

- Gold Protects You From Inflation

Inflation is a drop in the purchasing power of your dollar, otherwise known as fiat currency. When prices increase but wages don’t, the value of your dollar goes down. During periods of inflation, gold has held its value over the long term, especially when compared to fiat currencies.

Gold is a long-term investment, and many investors hold it as a hedge against inflation. When you own a gold investment during an inflationary time, your savings are safer.

- Invest in Gold Coins

In times of political unrest, it’s essential to have tangible assets that you can carry with you. Gold coins have been a valuable investment for many centuries. They’re portable, hold their value, and are easily traded.

Check out this Rare Metal Blogs recommendation for information on what gold coins are good to buy. When you take the time to do some research, it’s easier to choose gold as an investment.

- Increased Privacy

If you keep your investments in your home, you achieve a level of privacy. When you hold assets in a bank or an investment broker, your information can be accessible by the government. It’s also subject to a security hack.

If you invest in physical gold, you’ll need a secure place to store it. Many investors have a safe in their homes to hold these investments. Some brokers offer safe storage options. Your choice will depend on how quickly you want to access your gold.

- Diversification

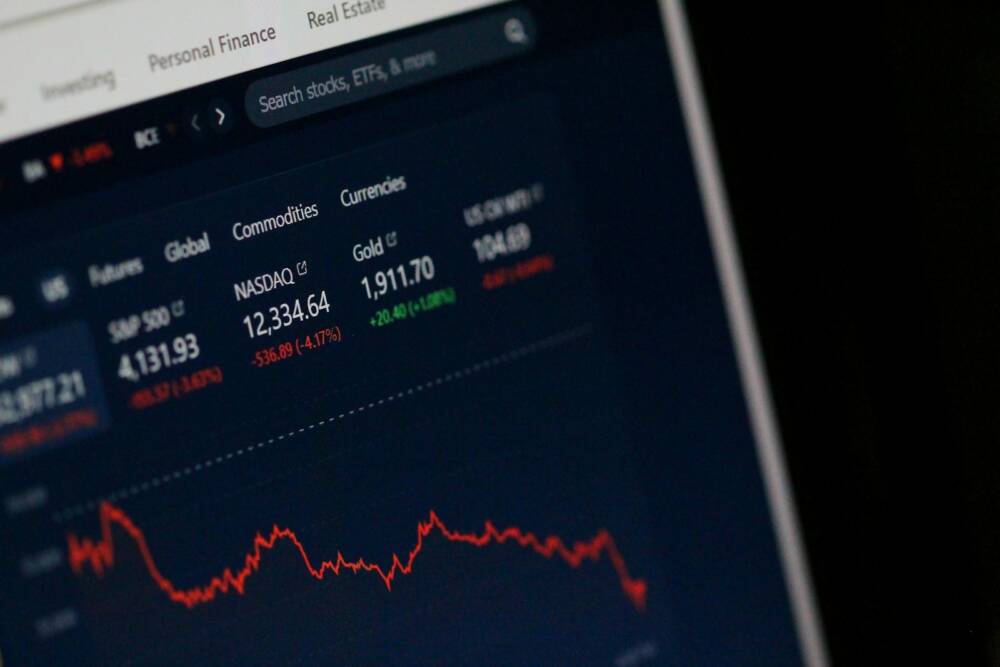

When you hold all of your investments in one type of asset, you are risking your savings. Diversification is an investment principle where you spread your investments over different types of assets.

You could hold a portion of your investments in gold, some in stocks, and another amount in real estate. That way, if one sector drops, you are more likely to retain some value in the other assets.

- High Liquidity

Gold is easy to buy and sell as a valuable tangible asset.

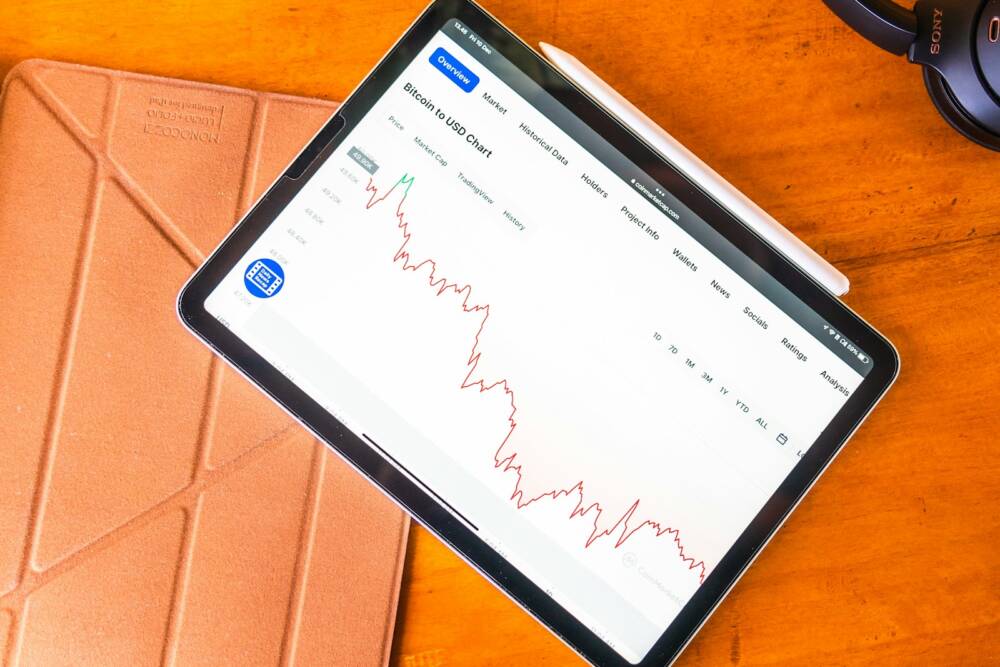

It has an agreed-upon value called a spot price. A spot price is a universally recognized value that you can check on at any time. It’s the fair market value of gold.

Many lenders will accept it as collateral if you need to borrow money. You can liquidate gold more rapidly than other tangible assets such as real estate or equipment if you need cash quickly.

Start Buying Gold Today

Now that you know why investing in gold, you can make your investment with confidence. Holding tangible assets gives you more flexibility and autonomy.

Did you find this article helpful? If so, be sure to use the simple search feature for more investment ideas.

MKTPlace is a leading digital and social media platform for traders and investors. MKTPlace offers premiere resources for trading and investing education, digital resources for personal finance, news about IoT, AI, Blockchain, Business, market analysis and education resources and guides.