So, you’ve decided to dip your toes into the world of investing. Congratulations! You’re about to embark on a journey that has the potential to help you grow your wealth and secure your financial future. But with so many investment strategies out there, how do you know where to start? Don’t worry, we’ve got you covered. In this beginner’s guide, we’ll walk you through the basics of navigating the complex world of investment strategies, helping you make informed decisions and set yourself up for success. Let’s dive in!

Introduction: Diving into the World of Investment Strategies

Are you ready to dive into the world of investment strategies? Whether you’re a beginner looking to grow your wealth or an experienced investor seeking new opportunities, understanding the various strategies available is crucial for success. From stocks and bonds to real estate and mutual funds, there are countless options to explore.

One of the first steps in navigating the world of investment strategies is to determine your financial goals. Are you saving for retirement, a new home, or simply looking to build wealth over time? Once you have a clear objective in mind, you can begin to research different investment options that align with your goals. Consider factors such as risk tolerance, time horizon, and desired returns when crafting your investment strategy. Remember, diversification is key to reducing risk and maximizing returns. Start exploring the world of investment strategies today and take control of your financial future.

Understanding Different Types of Investment Strategies

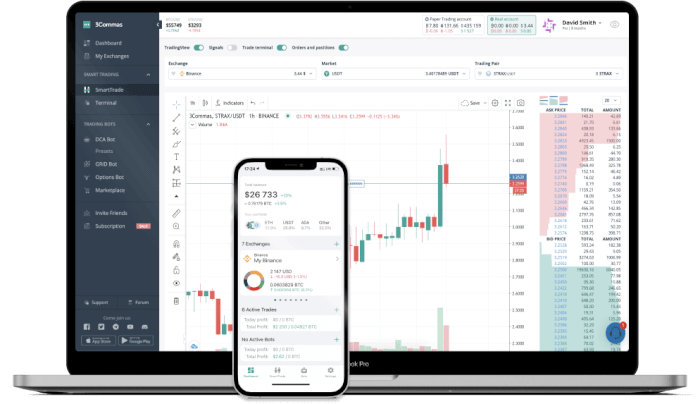

Investing can be a daunting task, especially for beginners who are just starting out in the world of finance. is crucial in order to make informed decisions and maximize returns. From long-term buy and hold strategies to more active trading approaches, there are various ways to invest your money in the market.

One popular investment strategy is dividend investing, where investors focus on building a portfolio of stocks that pay regular dividends. This strategy can provide a steady stream of passive income over time, making it a popular choice for long-term investors. Another common strategy is growth investing, which involves investing in companies with high growth potential. While this strategy can be more volatile, it also has the potential for higher returns in the long run. By understanding the different types of investment strategies available, you can choose the approach that best fits your financial goals and risk tolerance.

Choosing the Right Investment Strategy for Your Financial Goals

Investing can be a daunting task, especially for beginners who are just starting to dip their toes into the world of finance. With so many different investment strategies out there, it can be overwhelming to know where to start. However, by understanding your financial goals and risk tolerance, you can choose the right investment strategy that aligns with your needs.

One important factor to consider when choosing an investment strategy is your financial goals. Are you looking to save for retirement, buy a house, or simply grow your wealth? By clearly defining your financial goals, you can narrow down the options and choose a strategy that will help you reach those goals. Additionally, it’s important to consider your risk tolerance. Are you comfortable with taking on more risk for the potential of higher returns, or do you prefer a more conservative approach? Understanding your risk tolerance will help you select an investment strategy that fits your comfort level.

When it comes to investing, there is no one-size-fits-all approach. It’s essential to do your research, seek advice from financial professionals, and continuously monitor and adjust your investment strategy as needed. By taking the time to educate yourself and make informed decisions, you can navigate the world of investment strategies with confidence and work towards achieving your financial goals.

Tips for Successfully Implementing Your Chosen Investment Strategy

When it comes to successfully implementing your chosen investment strategy, there are a few key tips to keep in mind. First and foremost, it’s important to thoroughly research and understand the strategy you have chosen. This means taking the time to learn about the different types of investments available, as well as the risks and potential rewards associated with each.

Next, it’s crucial to set clear and achievable goals for your investments. Whether you are looking to save for retirement, build wealth, or simply generate some extra income, having a clear goal in mind will help guide your investment decisions. Additionally, it’s important to stay disciplined and stick to your strategy, even when the market may be fluctuating.

One effective way to stay on track with your investment strategy is to regularly review and adjust your portfolio as needed. This may involve rebalancing your assets, diversifying your investments, or reallocating funds based on market conditions. By staying informed and proactive, you can increase your chances of success in the world of investment strategies.

Key Takeaways

As you embark on your journey into the world of investment strategies, remember that knowledge is power. Take the time to educate yourself, seek advice from professionals, and never be afraid to ask questions. With patience, perseverance, and a little bit of risk-taking, you can build a solid foundation for your financial future. So go forth, dear reader, and may your investments bring you prosperity and success. Happy investing!

MKTPlace is a leading digital and social media platform for traders and investors. MKTPlace offers premiere resources for trading and investing education, digital resources for personal finance, news about IoT, AI, Blockchain, Business, market analysis and education resources and guides.