Master Your Money: Unlock Financial Success with These Proven Tips!

Achieving financial success may seem like an elusive goal, but with the right strategies and mindset, it can become a reality. Let’s consider how you can master your money: unlock financial success with these proven tips! Here are some proven tips that can help you unlock financial success and pave the way towards a secure and prosperous future:

1. Set Clear Financial Goals: Start by defining your financial goals. Whether it’s saving for retirement, buying a house, or paying off debts, having a clear vision of what you want to achieve will provide you with direction and motivation.

2. Create a Budget: A budget is a powerful tool that allows you to track your income and expenses. By creating a realistic budget, you can gain a better understanding of your financial situation and identify areas where you can cut back on unnecessary expenses.

3. Save and Invest Wisely: Saving and investing are essential for long-term financial success. Make it a habit to save a portion of your income regularly and explore different investment options such as stocks, bonds, or real estate. Diversifying your investments can help protect your wealth and generate passive income, helping you to generate a big enough nest egg to send your children off to college, hire an aide from a philadelphia home health care agency should you or a loved one require it as you grow old, or even, should it take your fancy, travel the world.

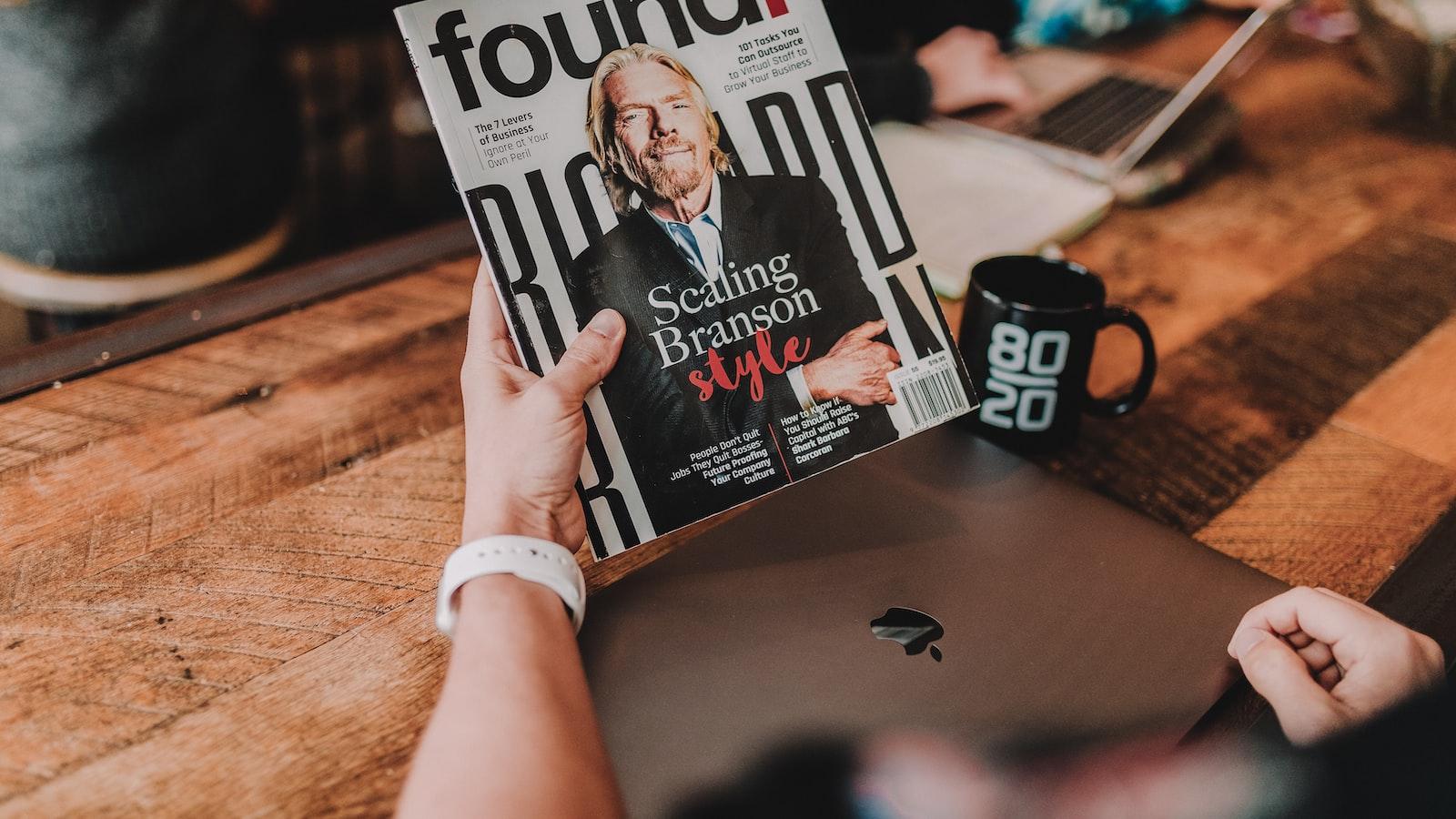

4. Educate Yourself: Financial literacy is crucial for making informed decisions about your money. Read books, attend seminars, take online courses, or check out the RIA podcast to enhance your knowledge about personal finance, investing, and wealth management. The more you educate yourself, the better equipped you will be to make sound financial choices.

5. Live Below Your Means: Avoid falling into the trap of lifestyle inflation, where your expenses increase as your income rises. Instead, strive to live below your means, keeping your expenses in check even when you experience a salary increase. This allows you to save more and build wealth over time.

6. Pay Off Debt: High-interest debt can be a significant obstacle to financial success. Prioritize paying off debts, starting with those with the highest interest rates. Consider debt consolidation or negotiating lower interest rates to accelerate the debt repayment process.

7. Build an Emergency Fund: Unexpected expenses can derail your financial progress. Establishing an emergency fund with at least three to six months’ worth of living expenses can provide a safety net during challenging times and prevent you from relying on credit cards or loans. Whether you’re facing a job loss, or need to research options for memory care near me to address the long-term needs of a loved one, an emergency fund can help you navigate these challenges with greater financial stability.

8. Seek Professional Advice: If you find managing your finances overwhelming or need guidance on investments, consider consulting with a financial advisor. They can provide personalized advice tailored to your specific goals and help you navigate complex financial matters.

Moreover, for those looking for specialized assistance, wealth management for high net worth families can be particularly beneficial. This service often focuses on comprehensive financial strategies that cater to the unique needs of affluent individuals and families, ensuring that their wealth is preserved and grown over time.

9. Continuously Track and Evaluate: Regularly review your financial progress and make adjustments as needed. Tracking your income, expenses, and investments allows you to identify areas for improvement and ensures that you stay on track towards your financial goals.

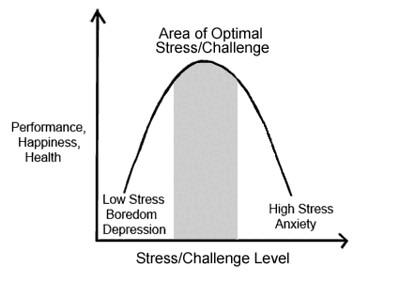

10. Stay Motivated and Persistent: Financial success requires discipline and perseverance. Stay motivated by reminding yourself of the benefits of achieving your goals, and don’t let setbacks discourage you. Stay focused on your long-term vision and keep pushing forward.

By implementing these proven tips, you can unlock financial success and create a solid foundation for a prosperous future. Remember that it takes time and effort, but with determination and the right strategies, you can achieve financial freedom and enjoy the peace of mind that comes with it.

Earn More Money: Powerful Strategies to Boost Your Income and Achieve Financial Freedom

Savvy Money Management: Expert Tips to Optimize Your Budget and Maximize Savings

Investing for Wealth: Unlocking the Secrets to Building a Profitable Portfolio

Smart Financial Habits: The Key to Long-Term Prosperity and Financial Independence

Do you want to break free from the cycle of relying on each paycheck? Are you longing for a life where financial concerns are not a perpetual source of stress?

It’s time to take control of your financial future and unlock the path to success. In this section, we’ll explore powerful strategies to earn more money, achieve financial freedom, and turn your dreams into reality.

One key factor to reaching your financial goals is mastering the art of savvy money management. This involves optimizing your budget and maximizing your savings. By carefully monitoring your income and expenses, you can identify areas where you can cut back and save more. To help you do this, we’ve gathered expert tips from financial gurus who have successfully navigated the financial landscape. From creating a realistic budget to finding creative ways to increase your savings, these experts share their tried-and-true strategies for achieving your financial goals. Remember, every dollar you save is a step closer to financial freedom.

Investing is another powerful tool on the journey to financial success. By unlocking the secrets of building a profitable portfolio, you can create a passive income stream that will support you for years to come. Our experts will guide you through the world of investing, demystifying complex concepts and providing practical advice. Whether you’re a beginner or an experienced investor, these tips will help you make informed decisions and maximize your returns. From diversifying your portfolio to understanding market trends, you’ll learn the strategies that have generated wealth for countless individuals. Start investing smartly, and watch your wealth grow.

But it’s not just about earning more and investing wisely; it’s also about cultivating smart financial habits. Building a strong foundation of financial discipline is the key to long-term prosperity and financial independence. Our experts will share the habits that have helped them achieve success, from setting clear financial goals to practicing mindful spending. By adopting these habits, you’ll develop the resilience and discipline needed to weather any financial storm and come out stronger on the other side. Financial independence is within your reach, and it starts with the choices you make today.

To sum it up, mastering your money is the first step towards unlocking financial success. By implementing the strategies and tips shared in this section, you can earn more, optimize your budget, invest wisely, and develop smart financial habits. Take control of your financial future and embark on a journey towards financial freedom. It won’t always be easy, but with dedication, perseverance, and the right knowledge, you can achieve anything. Begin now and witness as your aspirations become tangible. Keep in mind, the ability to achieve financial success resides within you.

In a world brimming with uncertainty and relentless demands, there is one shining beacon that can light the path towards financial freedom – mastering your money. As we bid adieu to this enlightening journey through the realms of wealth, we hope that you have grasped the pearls of wisdom we have carefully laid out before you.

Remember, dear reader, that the power to unlock your own financial success lies within your grasp. The key to this treasure trove of abundance is not hidden in some faraway land, but rather in the seemingly mundane aspects of our daily lives. By taking ownership of our financial decisions, we can reshape our future and manifest dreams we once thought unattainable.

As you embark on this newfound voyage towards prosperity, let these proven tips be your guiding compass. Embrace the magical allure of budgeting, for it is the guardian that will protect your hard-earned wealth. Embrace the transformative power of saving, for it is the alchemist that will transmute pennies into pounds. Embrace the art of investing, for it is the magician that will conjure abundance from the depths of the market.

But mere knowledge is not enough to ignite the flames of financial success. It is in the consistent application of these principles that true mastery lies. So, fuel your determination with a burning desire to conquer the obstacles that present themselves along the way. Break free from the chains of impulse spending, rise above the allure of instant gratification, and lay a foundation of financial discipline that will withstand the test of time.

Though the path may be arduous, and setbacks may darken your doorstep, within you lies an unwavering resilience. Dare to dream big, for the universe rewards those audacious enough to aspire. Dare to believe in your abilities, for self-belief is the bridge that bridges the gap between mediocrity and financial greatness.

As you bid farewell to these words, armed with a renewed sense of purpose, remember that the journey to financial success is not one meant to be traveled alone. Seek out like-minded individuals who share your passion for prosperity and surround yourself with the energy of abundance. Share your knowledge, learn from others, and together, let us inspire a future where financial freedom is the norm rather than the exception.

Master your money, dear reader, and watch as the humble notes in your pocket transform into a symphony of unbridled opportunity. Unlock the door to financial success and let it propel you towards a life filled with choices, security, and the freedom to create the reality you desire.

So, go forth, embrace these proven tips, and let your journey towards financial mastery commence. Your destiny of abundance awaits.